AUBURN NATIONAL BANCORPORATION (AUBN)·Q4 2025 Earnings Summary

Auburn National Posts Record Net Interest Income as Margin Expansion Continues

January 27, 2026 · by Fintool AI Agent

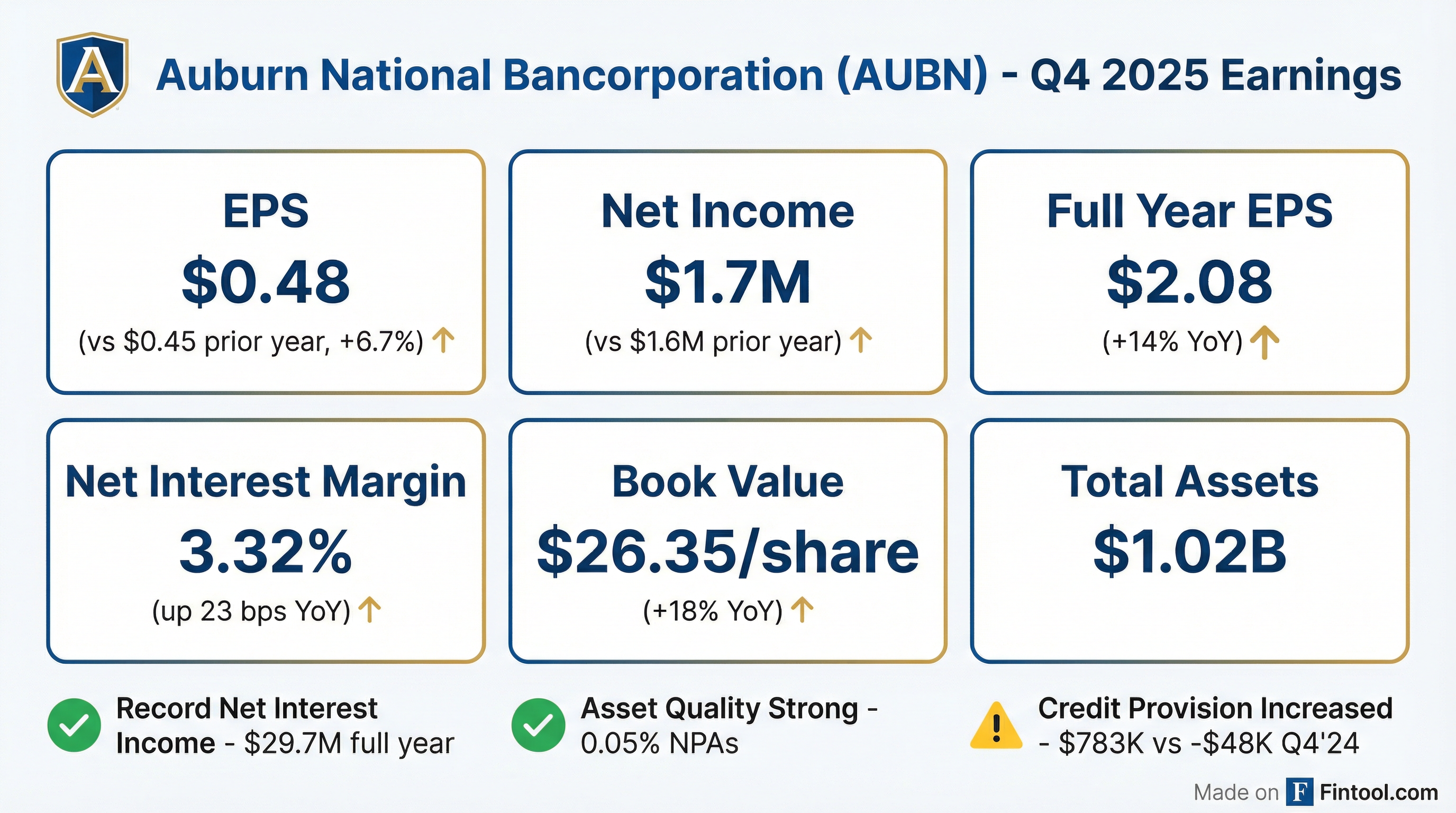

Auburn National Bancorporation (NASDAQ: AUBN) delivered Q4 2025 EPS of $0.48, up 6.7% year-over-year from $0.45, capping a strong full year that saw earnings per share climb 14% to $2.08. The East Alabama community bank posted record full year net interest income of $29.7 million, driven by continued margin expansion as the rate environment normalized.

Shares rose approximately 3% following the release, trading around $26.07 against a 52-week range of $19-$29.

Did Auburn National Beat Expectations?

Auburn National is a small-cap regional bank (~$91 million market cap) with limited sell-side coverage, making consensus comparisons unavailable. However, the year-over-year performance tells a clear story:

Full year 2025 results were particularly strong, with EPS of $2.08 representing a 14% increase from $1.83 in 2024.

What Drove the Strong Results?

Net Interest Margin Expansion was the primary driver. Management highlighted that improved yields on interest-earning assets combined with decreased cost of interest-bearing deposits expanded NIM to 3.32% in Q4 from 3.09% a year ago — a 23 basis point improvement. For the full year, NIM improved 21 basis points to 3.27%.

Record Net Interest Income: The bank achieved a full year record of $29.7 million in net interest income, up from $27.2 million in 2024 — a 9.4% increase.

Expense Discipline: Noninterest expense declined to $5.56 million in Q4 from $5.81 million in Q3, primarily from lower salaries and benefits and reduced occupancy costs. The efficiency ratio improved to 65.56% from 69.86% a year ago.

What Changed From Last Quarter?

The sequential comparison reveals a step-down from Q3's strong performance:

The primary driver of the Q4 vs. Q3 decline was elevated credit provisions. The $783K provision in Q4 compared to a negative provision (release) of $255K in Q3 created over $1 million swing in pre-tax income.

What's Behind the Credit Provision Increase?

Management attributed the increased provision to two specific borrowing relationships. Net charge-offs rose to $304K (0.22% annualized) from $78K in Q3 (0.06%), with charges primarily related to one of the two problem relationships.

Despite the uptick, overall asset quality remains sound:

The allowance coverage of 1,489% of nonperforming loans suggests ample reserves even after the Q4 provisions.

What Did Management Say?

CEO David A. Hedges highlighted several positives in his prepared remarks:

"Our fourth quarter and full year earnings reflect solid growth in our net interest income and margin, including record full year net interest income of $29.7 million. Although our provision for credit losses increased, primarily due to two loan relationships, our asset quality, capital, and liquidity remain strong, our outlook for loan growth in 2026 has improved, and we continue to make progress on our digital banking initiatives."

Key forward-looking comments:

- Loan growth outlook has improved for 2026

- Digital banking initiatives continue to progress

- Asset quality, capital, and liquidity remain strong

Balance Sheet Trends

Book value increased 18% year-over-year to $26.35 per share, driven by:

- Net earnings of $7.3 million

- Other comprehensive income of $10.2 million from decreased unrealized losses on securities

- Partially offset by $3.8 million in cash dividends paid

The tangible common equity ratio improved to 9.04% from 8.01% a year ago, well above regulatory minimums.

Notably, the bank maintains a conservative funding profile with no brokered deposits, FHLB advances, or other wholesale borrowings at quarter-end.

Capital Returns

Auburn National maintained its quarterly dividend at $0.27 per share, representing a 56% payout ratio for Q4. At current prices, the stock yields approximately 4.1% annually.

The full year payout ratio was 52%, suggesting the dividend is well covered by earnings.

How Did the Stock React?

Shares rose approximately 3% following the earnings release, trading around $26.07. The stock has recovered from its 52-week low of $19 and trades near the middle of its $19-$29 range.

At 102% of book value and 13x trailing earnings, AUBN trades at a modest premium to tangible book but at a discount to the broader regional bank sector.

Key Takeaways

Positives:

- Record full year net interest income of $29.7M

- NIM expansion continues (3.32% Q4 vs 3.09% prior year)

- Book value up 18% YoY

- Strong capital position (9.04% TCE ratio)

- No wholesale funding reliance

- Management sees improved loan growth outlook for 2026

Watch Items:

- Credit provision elevated due to two borrower relationships

- Net charge-offs increased to 0.22% annualized

- Sequential EPS decline from Q3's strong $0.64

- Limited trading liquidity (small-cap)

About Auburn National Bancorporation

Auburn National Bancorporation (NASDAQ: AUBN) is the parent company of AuburnBank, an Alabama state-chartered bank with approximately $1 billion in total assets. The bank has operated continuously since 1907 and serves East Alabama through seven full-service branches in Auburn, Opelika, Valley, and Notasulga, plus a loan production office in Phenix City.

Data sourced from Auburn National Bancorporation Form 8-K filed January 27, 2026. Stock price data from market data providers.